Aiding Banks to Optimize Their Payables Offerings for Enterprise Customers

Overview

IncedoPay is an integrated payables platform designed to meet the needs of both large enterprises and small businesses. Built to seamlessly connect banks, payers, and payees, IncedoPay simplifies and streamlines the payables ecosystem.

With connectivity to a broad payment network, the platform empowers users with flexible payment options, enhances transparency, and reduces support costs through intuitive self-service portals. IncedoPay strengthens security, ensures regulatory compliance, and enables end-to-end payables automation, transforming how businesses manage payments.

IncedoPay solution is accompanied by an efficient and scalable supplier enablement operation that financial institutions can also leverage as a separate service.

Offerings

IncedoPay is an innovative and best-in-class integrated SaaS Accounts Payable platform for banks that reduces the cost of ownership for enterprise clients and empowers them to increase focus on strategic and value-added treasury management activitiesBank Enterprise Client (Payer) Onboarding to the Platform

Bank Enterprise Client (Payer) Onboarding to the Platform

Download Case studySupplier / Payee Validation, Onboarding and Enablement

Supplier / Payee Validation, Onboarding and Enablement

Download Case studyIntegration with full range of B2B and B2C Payment Options

Integration with full range of B2B and B2C Payment Options

Download Case studyOngoing 24x7 support for all onboarded parties

Ongoing 24x7 support for all onboarded parties

Download Case studyAdvanced Data Analytics, Insights, and Reporting

Advanced Data Analytics, Insights, and Reporting

Download Case studyCompliance and Fraud Management Built-In

Compliance and Fraud Management Built-In

Download Case study- Segments

- Differentiators

- Resources

- Spotlight

- Partners

Segments

Banks

Banks

Large Enterprises

Large Enterprises

Small businesses

Small businesses

Case Studies

Insights and Resources

Spotlight

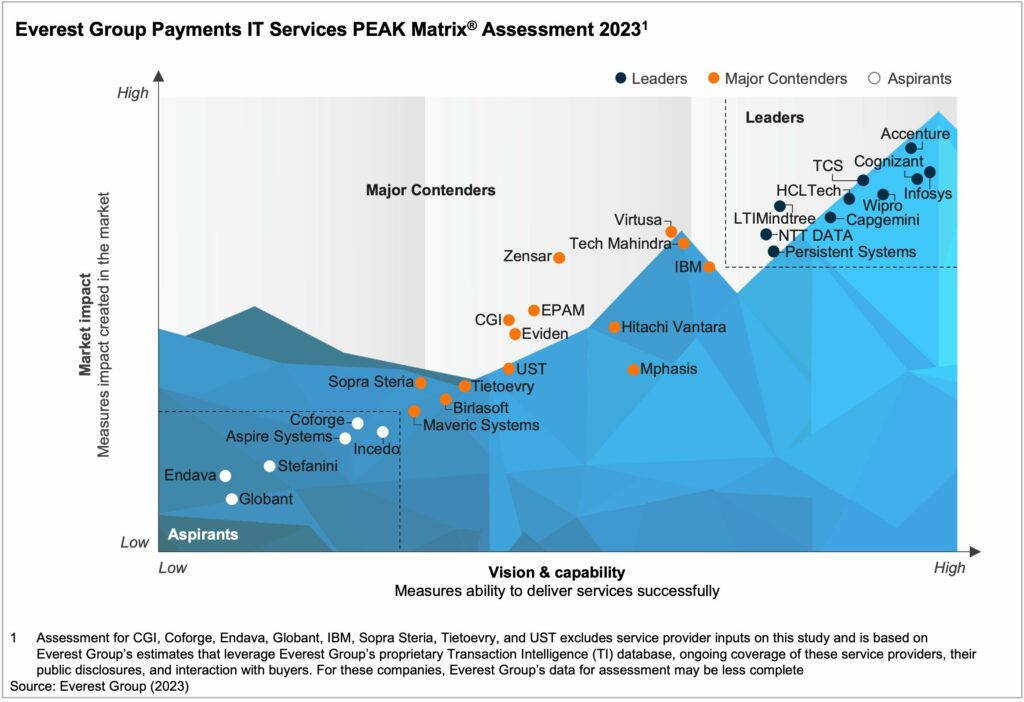

Incedo featured in the Everest Group Payments IT Services PEAK Matrix 2023

Partners

Our strong technology stack, digital expertise and partnerships with leading technology companies enable us to deliver superior digital experiences and strategies that increase revenue streams.