The magnitude of the spread of the COVID-19 pandemic has forced the world to come to a virtual halt, with a sharp negative impact on the economies worldwide. The last few weeks have seen one of the most brutal global equity collapse, spike in unemployment numbers, and negative GDP forecasts. With the crisis posing a major systemic financial risk, effective credit risk management in these times is the key imperative for the banks, fintech and lending institutions.

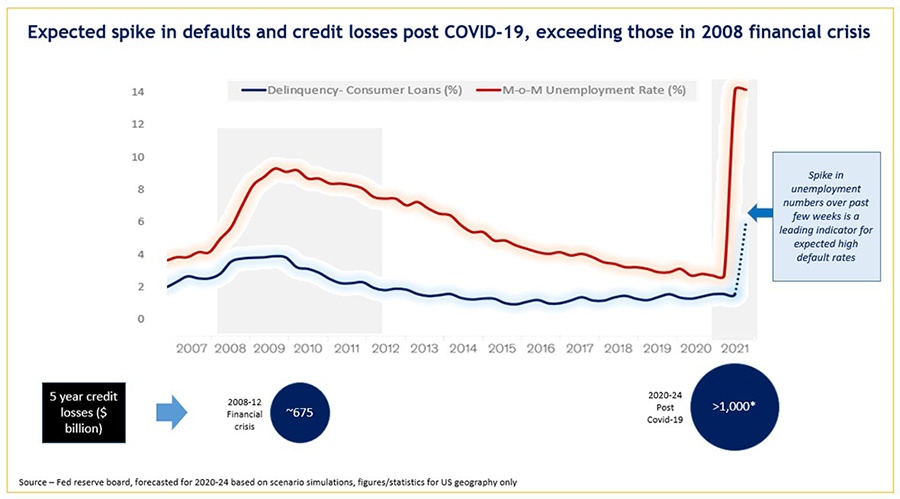

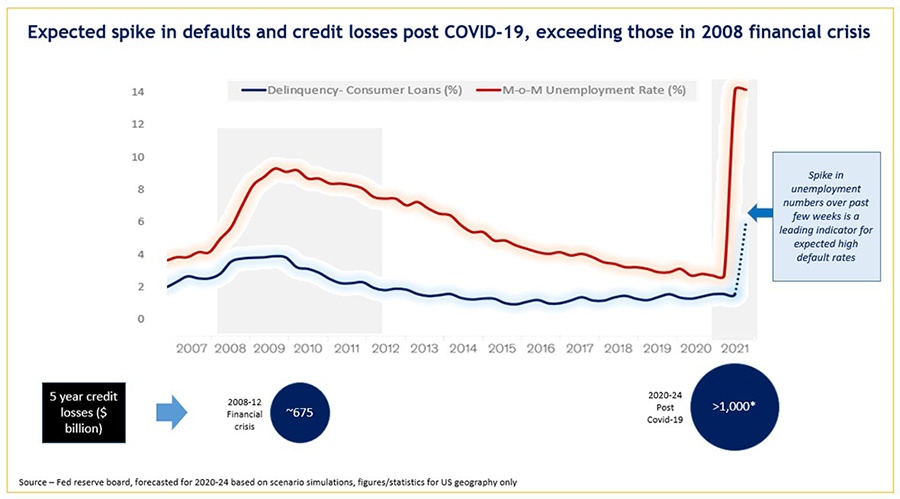

Expected spike in delinquencies and credit losses post COVID-19

The creditworthiness of banking customers for both retail and commercial portfolios has decreased drastically due to the sudden negative impact on their employment and income. In case of continuation of the epidemic for a longer-term period, the scenarios in terms of defaults and credit losses for banks could potentially be much higher than as observed in the global financial crisis of 2008.

Need for an up-to-date, agile and analytics driven credit decisioning framework:

The existing models that banks rely upon simply did not account for such a ‘black swan event’. The credit decisioning framework for banks based on existing risk models and business criteria would be suboptimal in assessing customer risk, putting the reliability of these models in doubt. There is an immediate need for banks to adapt new credit lending framework to quickly and effectively identify risks and make changes in their credit policies

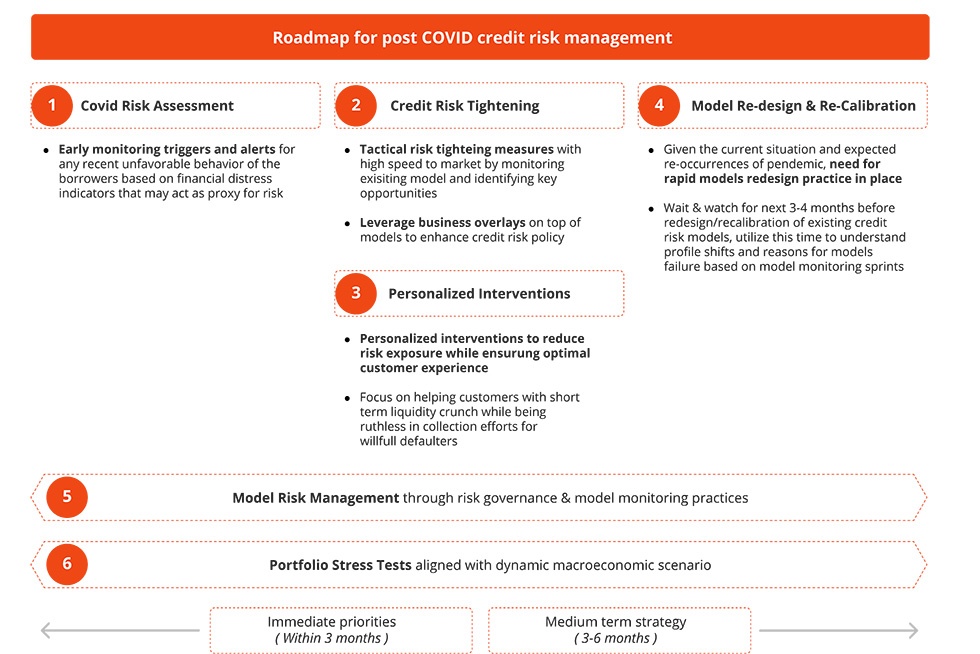

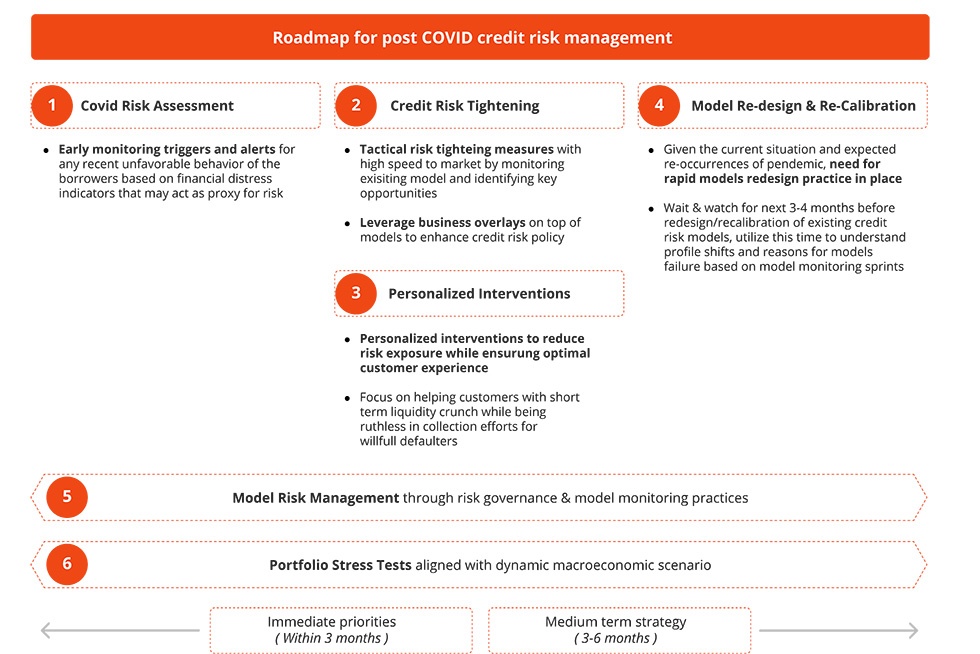

Incedo’s risk management framework for the post COVID-19 world

To address the challenges thrown up by the COVID-19, it is important to assess the short, medium and long-term impact on bank’s credit portfolio risk and define a clear roadmap as a strategic response focusing on changes to risk management methodologies, credit risk models and existing policies.

We propose a six-step framework for banks and lending institutions which comprises of the following approaches.

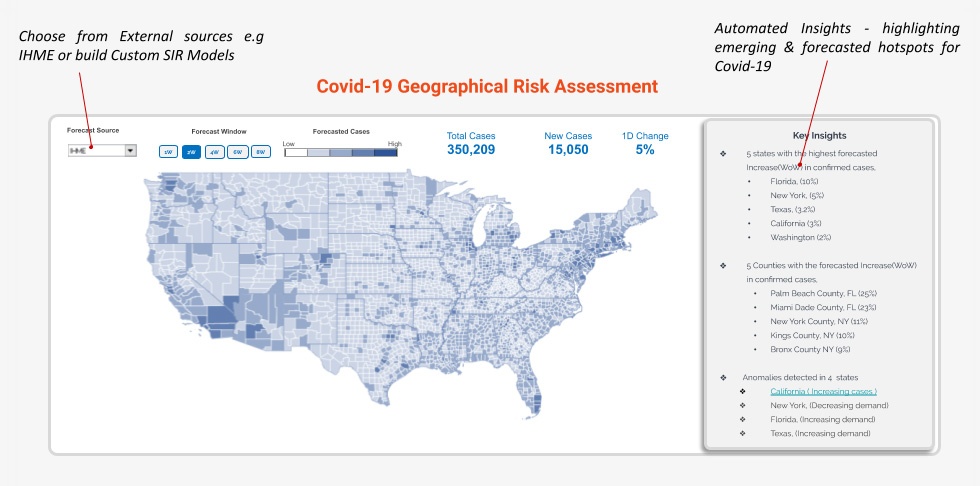

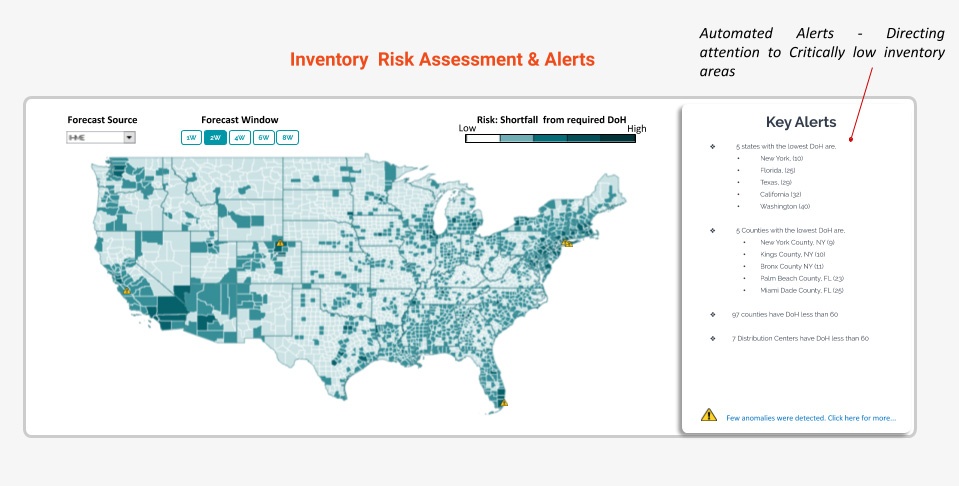

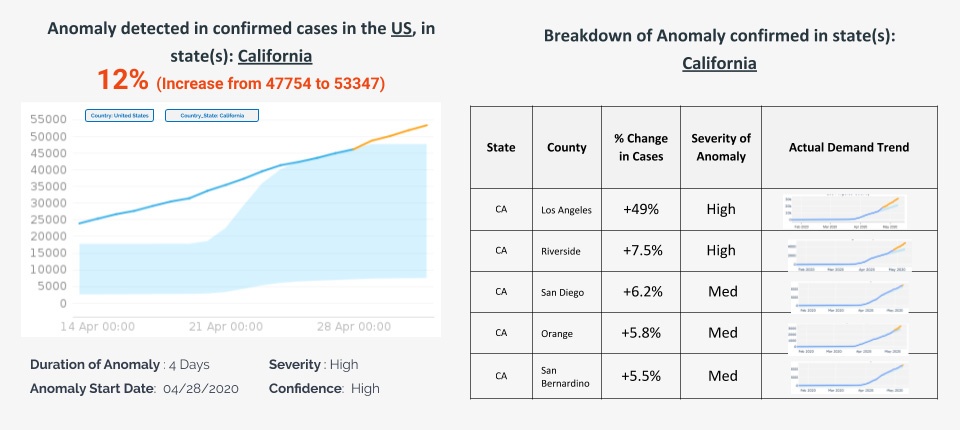

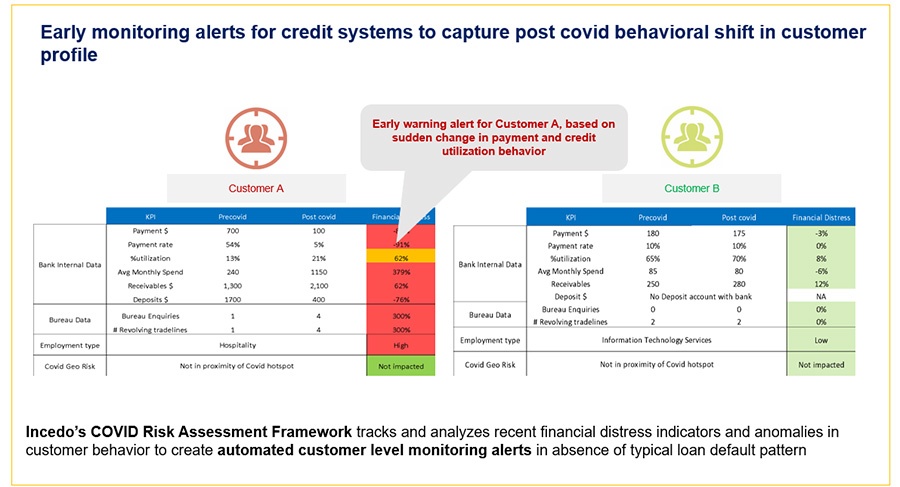

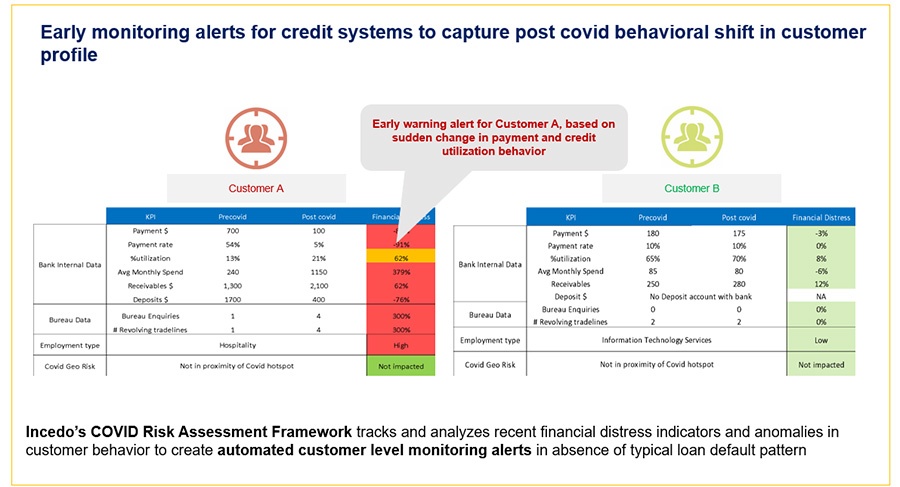

- COVID Risk Assessment & Early monitoring Systems

Banks and lending institutions should focus on control room efforts and carry out a rapid re-assessment of customer and portfolio risk. This should be based on COVID situational risk distress indicators and anomalies observed in customer behaviour post COVID-19. As an example, sudden spike in utilization for a customer, less or no credit of salary in payroll account, usage of cash advance facility by transactor persona could potentially be examples of increasing situational risk for a given customer. In the absence of real delinquencies (due to moratorium or payment holidays facility), such triggers should enable banks to understand customer’s changing profiles and create automated alerts around the same.

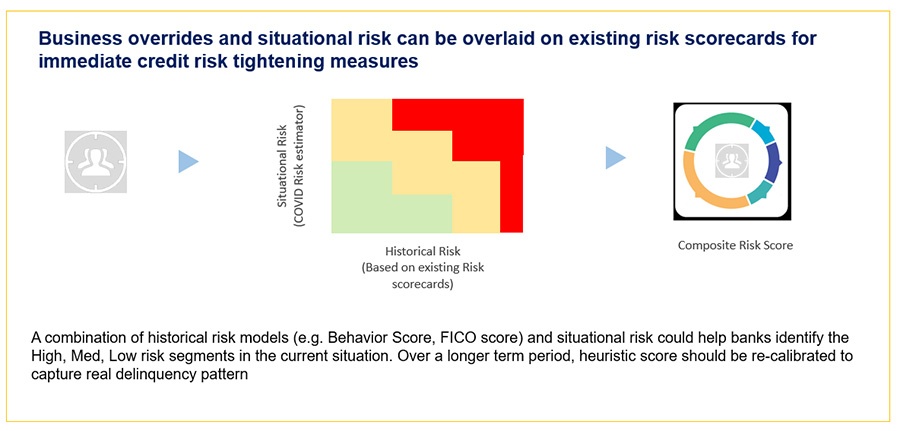

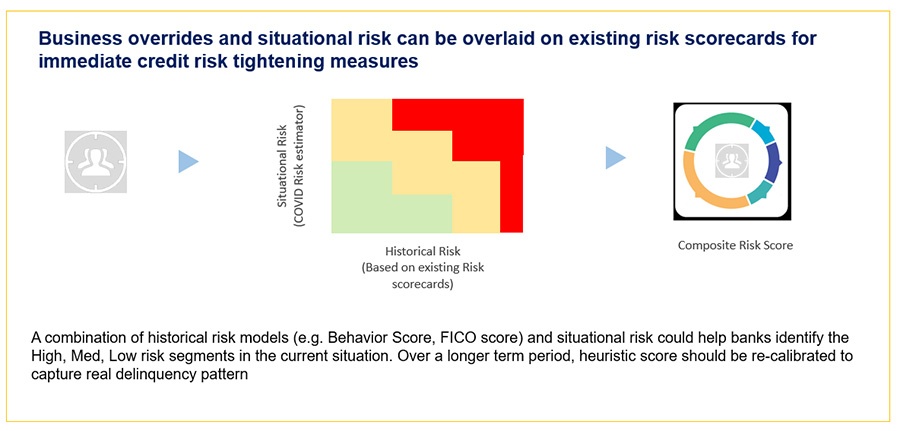

- Credit risk tightening measures

Whether you are a chief risk officer of a bank or a credit risk practitioner, by now you would have heard many times that all your previous credit risk models and scorecards would not hold and validate any longer. While that is true, it has also been observed that directionally most of these models would still rank order with only a few exceptions. These exceptions or business over-rides can be captured through early monitoring signals and overlaid on top of existing risk scores as a very short term plan. Customers with a low risk score and situational risk deterioration based on early monitoring triggers are the segments where credit policy needs to be tightened. As the delinquencies start getting captured, banks should re-create these models and identify the most optimal cutoffs for credit decisioning.

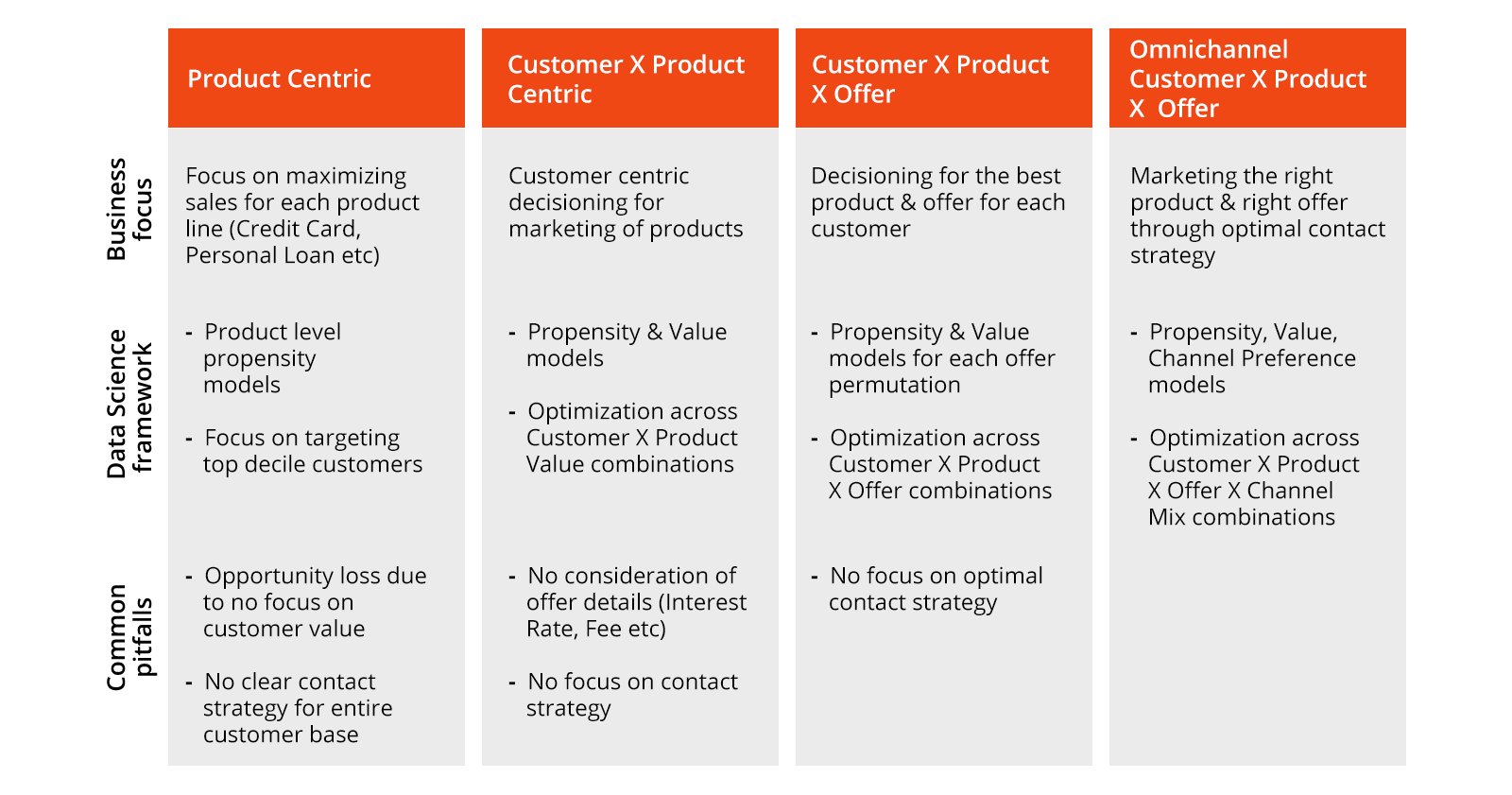

- Personalized Credit Interventions

There are still customers with superior credit worthiness waiting to borrow for their financial needs. It is very important for banks to discern such customers from those that have a low ability to payback. To do this, banks require personalized interventions to reduce risk exposure while ensuring an optimal customer experience through data-driven personalized interventions. Banks need to help customers with liquidity crunch through Government relief programs, bank loan re-negotiation, and settlement offers while building a better portfolio by sourcing credit to ‘good’ customers in the current low rate environment.

- Models Re-design and Re-Calibration

A wait and watch approach for the next 2-3 months period to understand the shifts in customer profile and behavior is a precursor before re-designing the existing models. This would enable banks to better understand the effect of the crisis on customer profiles and make intelligent scenarios around the future trend for delinquencies. There would be a need to re-calibrate or re-design the existing models. Periodic re-monitoring of new models would be a must, given the expected economic volatility for at least next 6-12 months period.

- Model Risk Management through Risk Governance and Rapid Model Monitoring

There is an urgent need for banks to identify and quantify the risks emerging due to the use of historical credit risk models and scorecards through Model monitoring. While the risk associated with credit products has increased, the delinquencies have not yet started getting captured in the bank’s database due to the payment holiday period facility introduced by govt’s of most of the countries. In such a situation, it is critical to design risk governance rules for new models that may not have information related to dependent variables (e.g. delinquency) captured accurately.

- Portfolio Stress Tests aligned with dynamic macro economic scenarios

Banks and lending institutions need to leverage and further build on their stress testing practice by running dynamic macro-economic scenarios on a periodic basis. The stress testing practice has enabled banks in the US to improve their capital provisioning and the COVID crisis should further enable banks across the geographies to use the stress tests to guide their future roadmap depending on how their financials would fare under different scenarios and take remedial actions.

The execution of the above-mentioned framework should ensure that banks and fintech’s are able to respond to immediate priorities to protect the downside while emerging stronger as we enter the new normal of the credit lending marketplace.

Incedo is at the forefront of helping organizations transform the risk management post COVID-19 through advanced analytics, while supporting broader efforts to maximize risk adjusted returns.

Our team of credit risk experts and data scientists has enabled setting up the post COVID early monitoring system, heuristic post COVID risk scores, and COVID command centre for a couple of mid-tier US based banks over a period of last few weeks.

Learn more about how Incedo can help with credit risk management.