The Covid -19 pandemic continues to disrupt the Pharma industry. As uncertainty around the pandemic lingers and refuses to go away, Pharma leaders are facing extraordinary challenges due to the following forces at work:

Rapid shift in demand of drugs due to the impact of Covid-19 – The pandemic has impacted the demand of drugs for various therapeutic areas differently. There is an unprecedented surge in demand for drugs which are being considered as treatment candidates for Covid-19 e.g Remdesivir (Gilead), Actemra (GNE) and Kevzara (Regeneron). There has also been a significant upsurge in demand for symptomatic medicines like antivirals, pain medications and ICU medicines which are used for managing complications from Covid-19. On the other hand, delays in elective surgeries and non-essential treatments have led to huge drop in Rx for many categories, and a rise of product switching in favor of self administered drugs

Geographical risk due to Covid-19 changing very quickly – After weeks of shutdown, some countries and states are cautiously reopening their economy. As regions open up, there are new emerging hotspots which can modify the density of cases, and hence the downstream impact on key decisions for Pharma Cos like inventory allocation for treatment therapies, supplier management and execution of clinical trials. Given the rapidly evolving dynamics with Covid-19, companies need to ensure that they are using the most updated data and case forecasts for decision making

Pharma forecasts are broken – For an Industry which relies very heavily on forecasting, the historic data on which all forecasting, planning and distribution systems are built on has changed. Many of the previous signals used for forecasting like seasonal patterns, events, channel characteristics and patient behavior might not hold true going forward. There are new behaviors like hoarding, preference for self administered drugs and movement to telehealth which challenge pre-existing assumptions. Forecasters need to factor in this “black swan” scenario into their assumptions, and the geographical risk of cases would be one of the key factors impacting Pharma KPIs

Given this scale of disruption, how can Pharma companies solve this?

Unprecedented problems can still be solved with conventional solutions. With the right tools, Data science can provide much needed clarity, direction and guidance on what is happening now , and what is expected to happen ahead. We propose a 5 step approach with a Covid-19 Control Room for Pharma companies which composes of the following components.

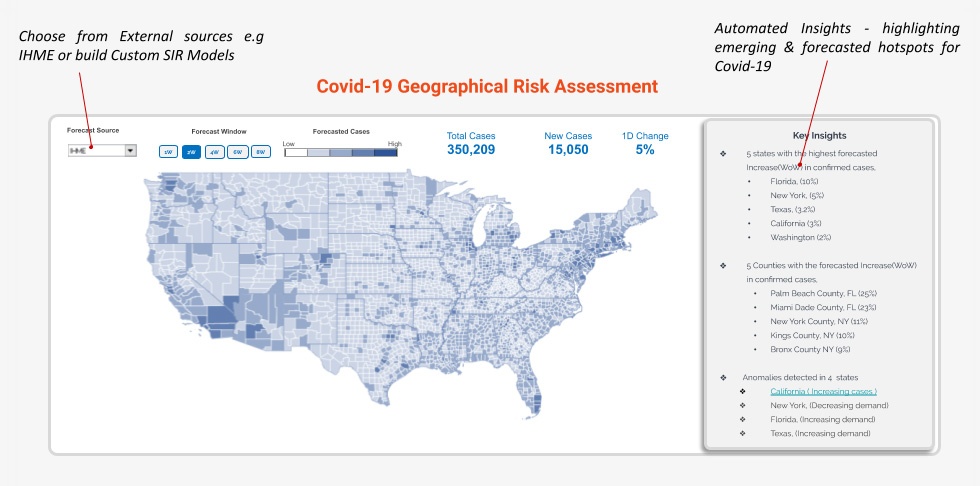

- Covid-19 geographic risk assessment – Assess how the Covid-19 epidemic would play out with estimation of Covid-19 cases at Country, State and County level. There are multiple sources of forecasts like IHME, Northeastern University, Columbia University or you can build custom SIER Models. Models are only as good as their assumptions, so it is advisable to look at forecasts from multiple models to capture the possible range of outcomes for assessment of the geographical risk. A dashboard view like the one below, with the ability to customize the forecast would be a foundation for the Covid-19 Control room. This base estimation of geographical risk can be used to model scenarios for a range of decisions e.g inventory allocation, supplier risk and clinical trial management being some of them

- Segmentation of drugs based on categories of consumption – If you observe the pattern of how demand is getting disrupted across therapeutic areas, there are 3 key demand archetypes that would emerge.

- Direct impact – For drugs which are in late stage clinical trials for treatment of Covid-19 e.g Actemra (GNE), Kevzara (Regeneron), Lopinavir+Ritonavir (AbbVie) – effects of hoarding or upsurge are leading to more than 5X increase in sales, with demand quickly outstripping supply. This has already led to shortages. Remdesivir which received emergency use authorization by FDA might be in shortage for a long time – Gilead reported there’s only enough of it for 200k patients around the world

- Secondary impact – For drugs which help in symptom management e.g pain/anaesthetic drugs like Paracetamol & Ibuprofen, antivirals like Rapivab and respiratory drugs have seen a huge uptick in demand e.g 91% increase in Paracetamol, 27% in Beclometasone, 23% increase in Salbutamol in the first week of Mar’20 compared to Mar’19. There are also a class of drugs used for Covid-19 complication management e.g ICU drugs like Epinephrine, Fentanyl and Oxycodone which have seen demand surges and reported shortages

- Negative or no impact – For some categories, demand has fallen sharply. In office administration volumes show huge drop in demand including certain categories of prescription drugs e.g -45% Rx for Pediatric Antibiotics. There are shifts based on mode of administration e.g IV administered oncology therapies show decreased demand relative to oral therapies

- Calibrate demand sensing for each demand archetype – Understanding the demand archetype of drugs in the company’s portfolio would enable forecasters to calibrate the demand post disruption and improve the accuracy of their forecasts. One of the key signals of drug demand at the distributor level is the geographic risk. For some like Actemra and Kevzara, the increase in demand would be directly proportional to the number of cases with Covid-19 in any region. E.g we know that Kevzara is a treatment candidate for patients with severe pneumonia due to Covid-19. Signals like number of expected cases, admission rates, patient demographics & access to the drug can be used to derive an accurate estimate of the demand for the drug. Similar analysis is needed based on demand archetype to calibrate forecasting techniques for other therapeutic areas given this ‘structural break’ in historic time series data due to Covid-19

- Develop strategies for short, medium and long term – Once you have a sense of impact on the therapeutic area, organize your efforts for the Covid-19 Control room which would provide a perspective on short term ‘Crisis management’, medium term ‘Risk management’ and long term ‘Restoration to normal’ initiatives. For Supply chains, the initiatives would be:

- Short term Crisis Management – Inventory risk assessment & allocation

- Medium term Risk management – exploring options for ramping up production, managing supplier risk and reducing lead time

- Long term Restoration to Normal – capacity planning, planning for recurring cycles of pandemic

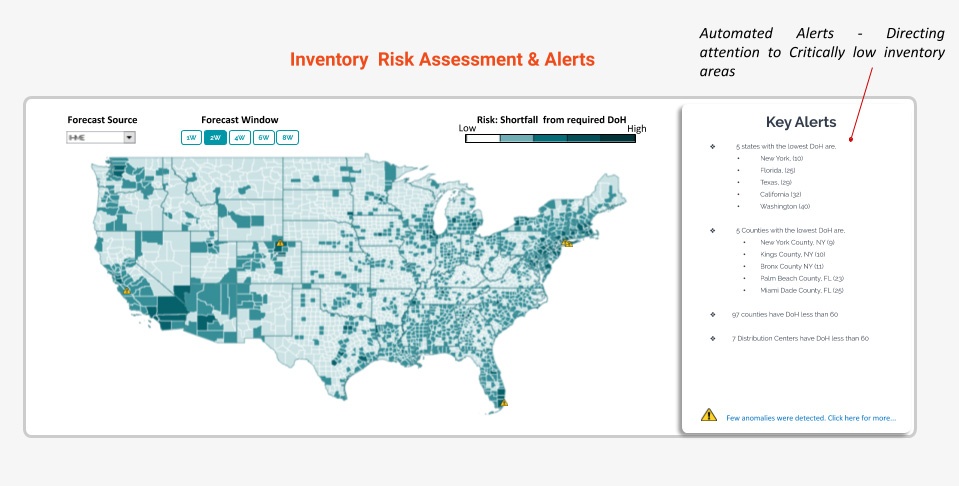

For example, here is an illustration of Inventory Risk assessment with key insights on Inventory Allocation at county level for a demand archetype with direct Covid impact. An inventory risk assessment and allocation solution would compute the mismatch between demand and supply – measured by the ‘shortfall from required DoH’ to surface alerts. This would ensure that inventory allocation is optimal – precious drugs are sent to the critical locations and hospitals who need it most.

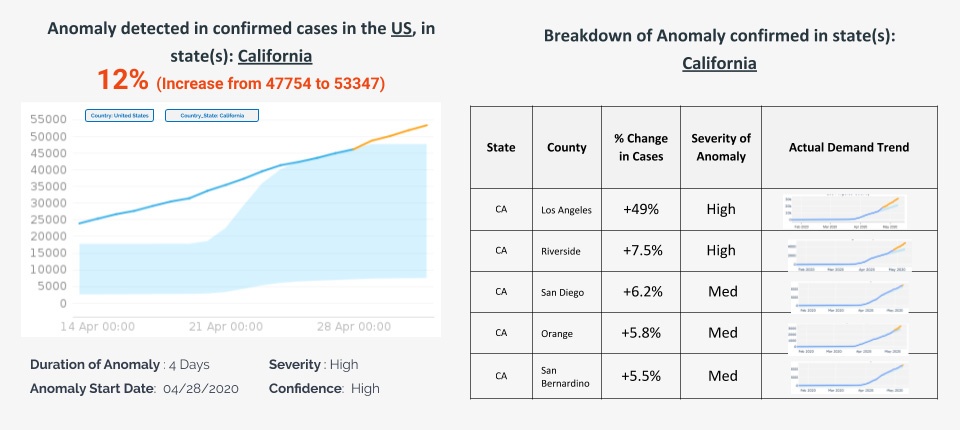

- Build early warning indicators – Covid-19 infections, as some expect, might stay and relapse long into the future – even after the first wave. Machine learning can be used to constantly analyze and correlate parameters like case rate, death rate and growths with anomaly detection systems which detect shifts in cases and identify emerging hotspots of infection. This will help companies quickly recalibrate decisions e.g here is a view of how an autonomous Anomaly detection system for the Covid Control room is built at country, state and county levels enabling decision makers to zoom in and out to identify hotspots quickly.

As we have all experienced, every day is a new unprecedented chapter in this outbreak of Covid-19. Strategies leveraging data and tools at our disposal can help Pharma companies win the battle against this pandemic. Companies that execute on these strategies will have a clearer view of what is expected to happen, and hence better prepared to face the challenges which lie ahead.

This Article is part 2 in the series – ‘Managing Pharma Supply Chains in times of Covid-19‘

For more insights on how Pharma companies can Optimize their Supply chains, please click here.