Wealth management industry is transforming rapidly as it pivots towards the fee based advisory model. The advisory model by nature requires a deeper level of relationship with the customers as compared to the commission based model which is more transactional in nature. At the same time, wealth managers are facing challenges from

- Changing client mix and expectations,

- Fee compression

- Fintech disruption.

You can read details about how digital disruption is shaping the wealth management industry in our previous blog. Investment management has been commoditized and is no longer a differentiator. A robo advisor can perform portfolio allocation much better and at a much lower cost than a human advisor. If the advisors expect to charge more than robo advisory fee then they need to offer personalized financial advice based on holistic understanding of the client’s life stage, risk profile, investment objectives, preferences etc.

Issues with Traditional Segmentation Methods

The foundation of all personalization efforts is rooted in understanding the clients better and segmenting clients along the slices of client value, potential, demography, behavior etc. Client segmentation is informally practiced at wealth management firms but tends to suffer from some limitations

- Static segmentation – Client segmentation is not a one time product purchase, it is a continuous and dynamic process. Customers move from one segment to another over a period and their investment preference, risk profiles can change based on their own life events or market conditions. For example, in the current zero interest environment there has been more demand for the riskier instruments even from the conservative investor segments. Traditional or one time segmentation tools are not able to consider drifts over a period and can therefore provide stale results.

- Just focused on Value – Every practice or financial advisor at an informal level knows their most valuable clients as measured by assets under management or fees/ commissions earned. But value-based segmentation only provides you descriptive inputs about the advisory practice. It ignores other key parameters that can help in personalizing investment decisions, service models etc. Example: life stage has direct correlation with investment recommendation eg. 529 plans for mass affluents with young kids or IRA rollover recommendations for pre-retirees.

- Not scalable – Informal or semi automated segmentation methods have trouble in scaling when the number of clients increase and segmentation variables multiply. Traditional segmentation models can place clients in one segment or another but tend to provide mixed results when the number of variables and data points increase. On an average an advisor has about 80-100 clients. If we are talking about a large advisory practice with multiple advisors or ensembles with a shared servicing model, it is not possible to keep track of all clients and their changing variables without automating it.

- Limits personalization – The end objective of segmentation is not just to place clients in one bucket or another, it needs to inform the decision making process for personalized next best action. A static or non automated segmentation process stays mostly at macro level. To personalize client recommendations, micro segments need to be created and the manual segmentation methods struggle with that objective. Example: Within the retirees macro segment, the objectives, risk profiles and investment patterns of early retirees will be different from those of late retirees. In the accumulation stage, the investment objectives of investors with kids will be different from those with double household income and no kids. Unless we create micro segments, wealth managers will continue to provide advice which may be generic and at worst non contextual.

Growing use of ML/ Data science in Client Segmentation

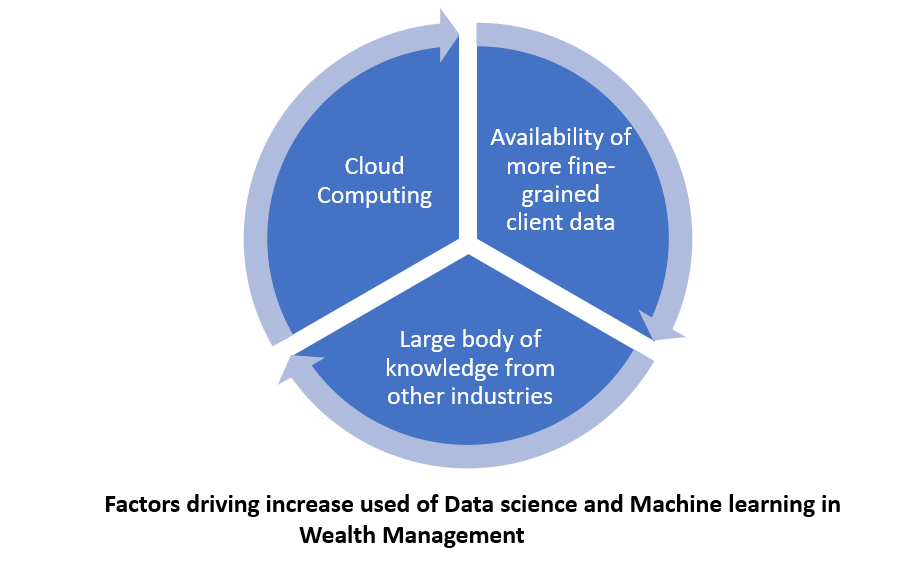

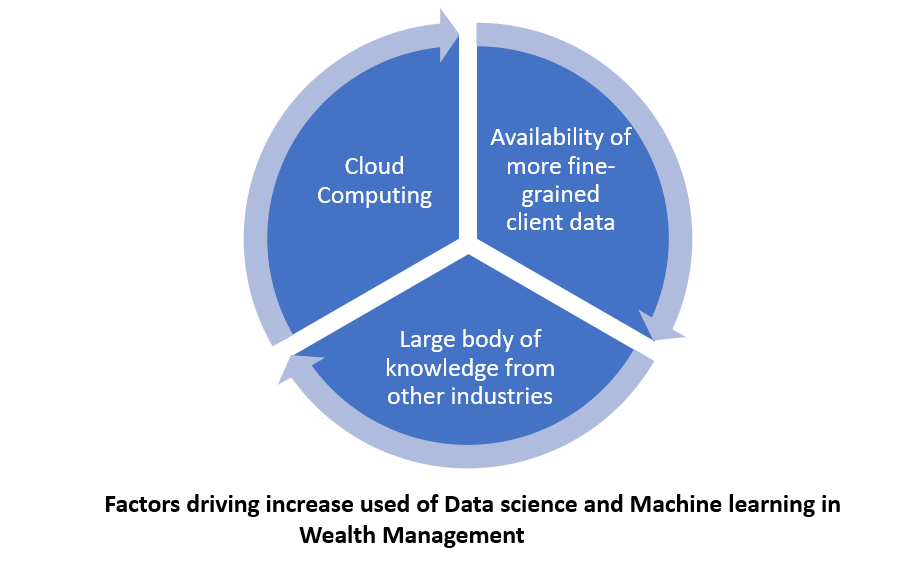

Although the use of data science and machine learning is growing in the wealth management space, the industry still lags various other consumer facing industries in using the full potential of Data and AI/ML. Today, there are multiple factors which are making it easier for wealth managers to use the power of machines to build segmentation engines.

- The data sources and volumes have exploded and there is much more fine grained level of client data available than ever before.

- There is large body of knowledge from the experience of other industries on how ML based segmentation enables data driven marketing

- Lastly, cloud now allows for unlimited compute capacity by spinning concurrent workloads to perform complex processing and data analytics at minimal costs.

Various wirehouses, BDs, RIAs, technology providers over the last few years have started using AI to drive their segmentation model and recommendation engines. Machine learning based client segmentation can create data driven clusters which may not be readily visible via manual segmentation. Machine learning algorithms can analyze multiple deterministic features and analyze their correlation to create unsupervised clusters sharing homogeneous characteristics and behavior patterns. Such clustering does not suffer from any unconscious bias stemming from informal segmentation.

A scalable machine learning based segmentation model relies on the following data types and is able to slice customer data along multiple dimensions. Some examples below:

| Segmentation Type | Based on | Segment Example | Data Required |

|---|---|---|---|

| Geographic & Demographic | Location, Age, Income, Profession, gender | Urban vs Rural Millennials vs Baby Boomers | Client & Account Data |

| Value/ Potential Value | GDC , AUM, Type of Revenue (Fee vs Commissions), Networth | UNHW, HNW, Mass Affluent, Masses High Value Vs Low Value | Trades Date, Advisory Billing data, Positions Data |

| Risk Profile | Goals, Risk Profile, Return objectives, Time Horizon | Conservative vs Aggressive Investor | Suitability Data |

| Behavioral | Trading Frequency,& Patterns | Passive vs Active Investor | Trades Data, Positions Data, CRM |

| Technographic | Engagement with Applications | Technologically challenged vs Tech Savvy Clients | Portal & App Analytics ( Number of logins, time spent) |

This data can also be supplemented with external data to provide additional insights which may not be apparent from the first party data. For example, first party data such as client zip location when supplemented with external census data can provide valuable information about zip affluence, education level, demographic segment etc. Similarly, held away investments and accounts data can help paint a holistic financial picture of the client and determine the advisor’s wallet share.

Client Segmentation across Customer Journey

Let us see how client segmentation aids data driven decision making and helps in improving key metrics during the client’s journey:

Client Acquisition- RIAs can align their prospecting efforts with the client segment value proposition to ensure a larger prospect funnel and higher prospect to client conversion . As per the Schwab 2020 RIA benchmarking study, the firms that adopted an ideal client persona and client value proposition attracted 28% more new clients and 45% more new client assets in 2019 than other firms. Therefore the first step is to identify your target segment and align your messaging and marketing accordingly. example

- A business development campaign aimed at Pre retirees and retirees needs to focus on themes of safety & capital preservation while one focussed on young professionals will focus on themes of growth and return. Segmentation engine can identify geographic areas which are likely to have prospects that match the firm’s target segments and where a particular campaign will find most resonance

- In another example, the segmentation engine can classify the leads and prospects data into specific segments by matching the lead characteristics with existing client segments. Segmentation engines can predict if a lead is likely to become a high value customer and also suggest the kind of campaign that will appeal to them.

- Wealth Managers are now combining client segmentation and advisor segmentation to predict and match which advisors will best serve a prospective client based on prospect’s preferences, life stage etc

Client Growth- To capture the greatest wallet share of their clients, advisors should tie the investment recommendations to the client’s demographic, psychographic and risk segmentation. We talked earlier about recommendations for 529 plans for investors with young kids and rollover recommendations for pre retirees. Some more examples on how customer segmentation engines are feeding into next best action platforms to provide contextual recommendations for clients:

- Growing popularity of ESG with the younger investors or the increased sales of life insurance to the urban middle age group during pandemic are good examples of how advisors and product companies align product recommendations with client segment’s preferences.

- Similarly, if the clients are more focused on increasing their retirement savings, then recommendation around how they can contribute more than defined limits using backdoor roths will be appreciated by client

- If the client is in a high tax bracket currently, then the advisor needs to recommend tax deductible IRAs while if they are going to be in higher tax brackets during their retirement, then Roth IRAs may be a better investment vehicle.

- When segmenting based on the client’s browsing behavior, wealth managers can also send research reports and/or articles pertaining to sectors/ investment products that the client searches for in the portal. In addition, the portal can provide these inputs to advisors on the client dashboards for their next conversation.

As technology such as direct indexing mature further, clients will increasingly ask for customization based on their values, preference, beliefs and the wealth managers will have to offer customized portfolios at scale.

Client Servicing- Effective segmentation also helps in building a tiered service model with differentiated services to the most valuable clients and repeatable services to all other clients. Some wealth management firms craft personalized experiences for their top clients based on their hobbies and interests. Psychographic and technographic segmentation also help in devising the service channel for the clients. For example,

- Clients that delegate all their investment responsibilities to their advisors and give them discretion on their accounts tend to prefer a light touch servicing model.

- Clients who want high touch services and want to validate investment decisions would be more impressed by detailed research and analysis.

- While a third category technically savvy clients want to have all the information , portfolio and plan details available anytime anywhere and prefer online service channels

Client Retention- A client mix skewed towards low value and unprofitable clients can encumber and advisory practice’s service levels & profitability and can put the most valuable clients at attrition risk. Many wealth managers have their bottom 50-60% of clients contributing only about 5% of their revenues and the top 20% accounting for more than 80% of the revenue. Therefore, advisors should periodically shrink to grow better. Client segmentation can help wealth managers prioritize clients for retention and for letting go based on current value, potential future value, influence potential. Ageing baby boomer population has brought on another kind of client attrition risk for advisors. As per industry studies, the financial advisors are not retained 70% to 90% of the time when the wealth transfers to the next generation. The client retention efforts in such cases therefore not only need to focus on the immediate clients but also on the next generation.

Segmentation is a growth as well as a Defensive Imperative

Thus, ML based segmentation can greatly aid data driven marketing efforts for wealth managers and lead to a higher return on the marketing dollars. It leads to measurable efficiencies in client servicing, attracting more clients and retaining high value clients. Lastly, it lays the foundation for a personalization engine for targeted recommendation, communication and servicing. While we have focussed above on how client segmentation can turbocharge an advisory practice’s growth, it is also a defensive imperative for the wealth management industry. FAANGs have perfected customer segmentation and personalization to an art form and are eagerly eyeing trillions of dollars of the wealth management industry. Wealth managers would do well to weaponize their data by using the power of machines and insulate themselves against the looming threat of big pocketed disruptors.

To achieve the full promise of ML based segmentation, data infrastructure needs to support running of segmentation models at scale. To paint a holistic client picture, wealth management firms also need to break data silos and ensure availability of high quality, harmonized and consumable client data. Our next blog will discuss the data challenges in the wealth management industry and how the modern data management techniques can help overcome these challenges. Till then Happy Segmenting.