COVID-19 pandemic has brought a significant change in the way financial advisors manage their practices, clients and home office communication. Along with the data driven client servicing platforms, smooth transition and good compensation, advisors are closely evaluating their firm’s digital quotient to provide them the service and support in times of such crisis and if not satisfied, may look out options of switching affiliation during or post this crisis.

This pandemic is not a trigger rather has provided additional reasons for advisors to continue to look out for a firm that fits better in their pursuit of growth and better client service.

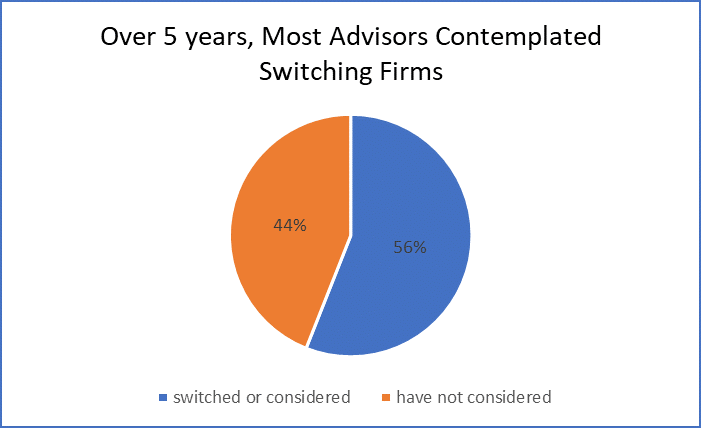

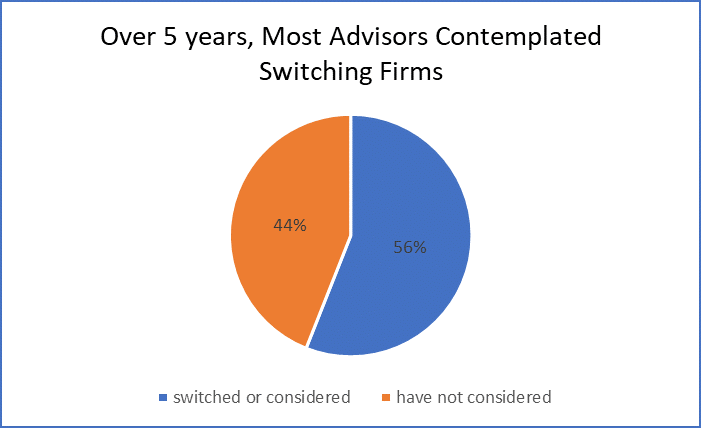

2018 Fidelity Advisor Movement Study says, 56% of advisors have either switched or considered switching from their existing firms over the last 5 years. financial-planning.com publishes that one fifth of the advisors are at the age of 65 or above and in total around 40% of the advisor may retire over the next decade.

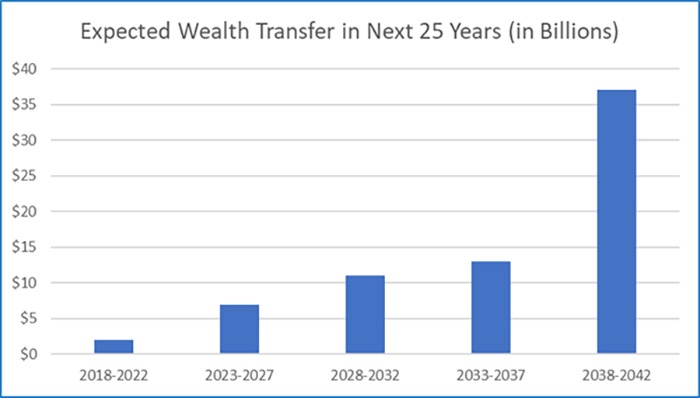

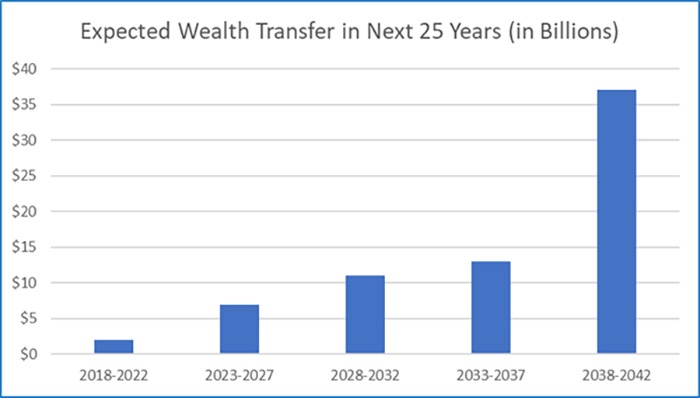

A Cerulli report anticipates transition of almost $70 trillion from baby boomers to Gen X, Gen Y and charity, over the next 25 years. Soon, the reduction in the advisor workforce will create a big advice gap, that the wealth management firms will have to bridge by acquiring and retaining the right set of Advisors

We are observing a changing landscape of advisor and client population, mounting cost pressure due to zero commission fee and the need for scalable operations. COVID-19 has further accentuated the need for the firms to better understand the causal factors for changes in advisor affiliation, to optimize their resources deployed for engaging through the Advisor life cycle. The wealth management firms are increasingly realising that a one fit for all solution may not get optimal returns for them.

Data and Analytics can help the firms segment their advisors better and drive better results throughout the advisor life cycle. Advisor Personalization, using specific data attributes can deliver contextual and targeted engagements and can significantly improve results by dynamically curating contextual & personalized experiences through the advisor life cycle.

A good data driven advisor engagement framework defines and measures key KPIs for each stage of the advisor lifecycle and not only provides insights on key business metrics but also addresses the So What question about those insights. As wealth management firms collect and aggregate data from multiple sources, they are also increasingly using AI/ML based models to further refine advisor servicing.

Let us look at the key goals or business metrics for each stage of the advisor life cycle below and see how data and analytics driven approach helps in each stage of the life cycle.

Prospecting & Acquisition

To attract and convert more high producing advisors, recruitment teams should be tracking key parameters through the prospecting journey of the advisors so that they can identify:

- What is the source of most of their prospective advisors; RIA, wirehouses, other BDs

- Which competitors are consistently attracting high producing advisor

- What % of advisors drop from one funnel stage to another and finally affiliate with the firm

- What are the common patterns and characteristics in the recruited advisors

Data driven advisor recruitment process that relies on the feedback loop helps in the early identification of potential converts, thereby balancing the effort spent on recruited vs lost advisors. It also improves the amount and quality of the recruited assets.

For example, analysis of one-year recruitment data of a large wealth management firm revealed that prospects dealing with variable insurance did not eventually join the firm due to the firm’s restricted approved product list. Another insight revealed that prospects with a higher proportion of fee revenue vs the brokerage revenue increased their GDC and AUM at a much faster rate after one year of affiliation. Our Machine Learning Lead Scoring Model used multiple such parameters and scored a recruit’s joining probability and 1-year relationship value to help the firm in precision targeting of high value advisors. These insights allowed the firm to narrow down their target segment of advisors and improved conversion of high value advisors.

Growth & Expansion

A lot of focus during the growth phase of the advisor lifecycle is on tracking business metrics such as TTM GDC, AUM growth, commissions vs Fee splits. The above metrics however have now become table stakes and the advisors expect their firms to provide more meaningful insights and recommendations to improve their practices. Some of the ways, firms are using data to enhance advisor practice are by:

- Using data from data aggregators and providing insights on advisor’s wallet share and potential investment opportunities

- Providing peer performance comparisons to the advisors

- Providing next best action recommendations based on the advisor and client activities

For example, our Recommendation Engine analysed advisor portfolio and trading patterns and determined that most of the high performing advisors showed similar patterns in Investment distribution, asset concentration, churning %. This enabled the engine to provide targeted investment recommendations for the other advisors based on their current investment basket and client risk profile. The wealth management firms are also using advisor segmentation and personalization models based on their clients, Investment patterns, performance, digital engagement, content preference and sending personalized marketing and research content for the advisors based on their personas thus driving better engagement.

Maturity and Retention

It is always more difficult and costly to acquire new advisors as compared to growing with the existing advisor base. The firms pay extra attention to ensure that their top producer’s needs are always met. Yet despite their best efforts, large offices leave their current firms for greener pastures or higher pay-outs. The firms run periodic NPS surveys with their advisor population which indicates overall satisfaction levels of the advisors, but they do not generate any insights for proactive attrition prevention. Data and analytics can help you identify patterns to predict advisor disengagement and do targeted proactive interventions.

For example, our attrition analysis study for a leading wealth manager indicated that a large portion of advisors over the age of 60 were leaving the firm and selling out their business. This enabled the firm to proactively target succession planning programs at this age demographic of advisors. Our analysis also indicated a clear pattern of decreased engagement with the firm’s digital properties and decreasing mail open rate, for the advisors leaving the firm. Based on factors such as age, length of association with the firm, digital engagement trends, outlier detection, our ML based Attrition Propensity model created attrition risk scores for advisors and enabled retention teams to proactively engage more with at-risk advisors and improve retention.

As per a study from JD Power, wealth management firms have been making huge investments in new advisor workstation technologies designed to aggregate market data, client information, account servicing tools and AI-powered analytics into a single interface. While the firms are investing heavily in technology, only 48% advisors find the technology their firm is currently using, to be valuable. While only 9% of advisors are using AI tools, the advisor satisfaction is 95 points higher on a 1000-point scale when they use AI tools. Advisors find a disconnect between the technology and the value derived from the technology.

This further necessitates the need for personalised solutions for advisors and an AI driven Advisor personalisation platform which provides curated insights to the firms. This helps in targeted & personalized services & support to advisors through the Advisor lifecycle, enabling optimal utilization of the firm’s resources and unlocking huge growth potential.

The firms that will understand the potential of data driven decision making for their advisor engagement and will start early adoption of such tools will thrive in these uncertain times and will emerge as a winner once the dust settles.