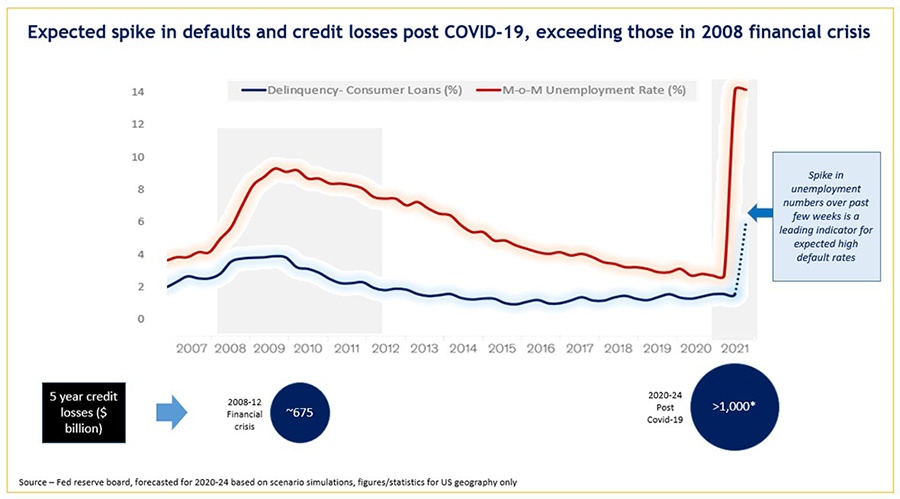

While the reckless overextension of credit lines by lenders and banks was the root cause of the financial crisis of 2007-09 and it had the US primarily as its central point, this time the financial crisis has been caused by a virus with rapidly evolving geographical centers and covering almost the entire world. The banks though are in a catch 22 situation, they need to support the government’s lending and loan relief measures while also maintaining low credit loss rates and enough capital provisioning for their balance sheet. Effective risk management and credit policy decisioning was never as challenging for the banks as it is now in the post covid-19 world.

COVID-19 implications and challenges for banks and lending institutions

Sudden shift in risk profile of retail and commercial customers – The surge in unemployment, deteriorated cash flow for businesses, etc has led to a sudden shift in the credit profile of customers. The data that banks used to leverage before COVID might not provide an accurate picture of the consumer’s risk profile in the current times.

Narrow window of opportunity to re-define credit policies – Bank’s credit policies in terms of origination, existing customer management, collections, etc have been designed over years with a lot of rigor, market tests, design and application of credit risk models and scorecards, etc. The coronavirus has caught the bankers and Chief Risk Officers by surprise and there is a narrow window of opportunity to make changes in existing models and risk strategies. While a lot of banks had built a practice of stress testing for unfavorable macroeconomic scenarios, the pace and impact of coronavirus have been unprecedented. This requires immediate response from the banks to mitigate the expected risks.

Government relief programs like payment moratoriums – The introduction of payment holidays and moratorium programs are effective to take some burden off consumers but prevent the banks from understanding high risk customers as there is no measure of delinquency that banks can capture from existing data.

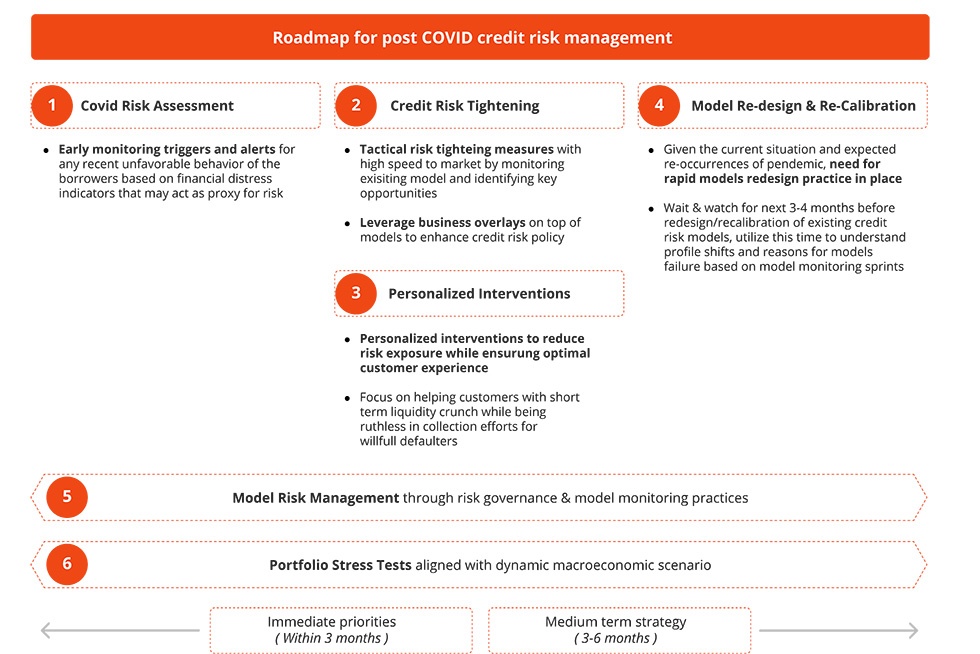

Four-point action plan and strategy to navigate through the COVID-19 crisis

Banks will need to go back to the drawing board, re-imagine their credit strategy and put in accelerated war room efforts to leverage data and create personalized risk decisioning policies. Based on Incedo’s experience of supporting some of the mid-tier banks in the US for post COVID risk management, we believe the following could help banks and lenders make a fast shift to enhanced credit policies and mitigate portfolio risk

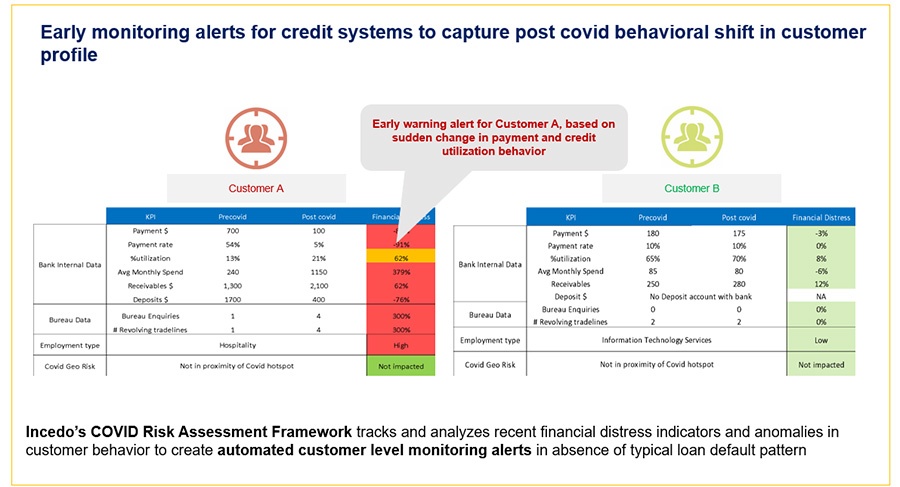

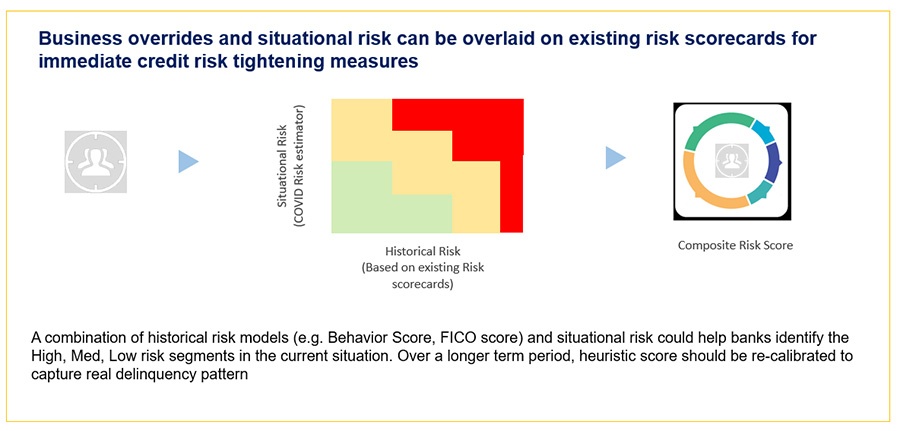

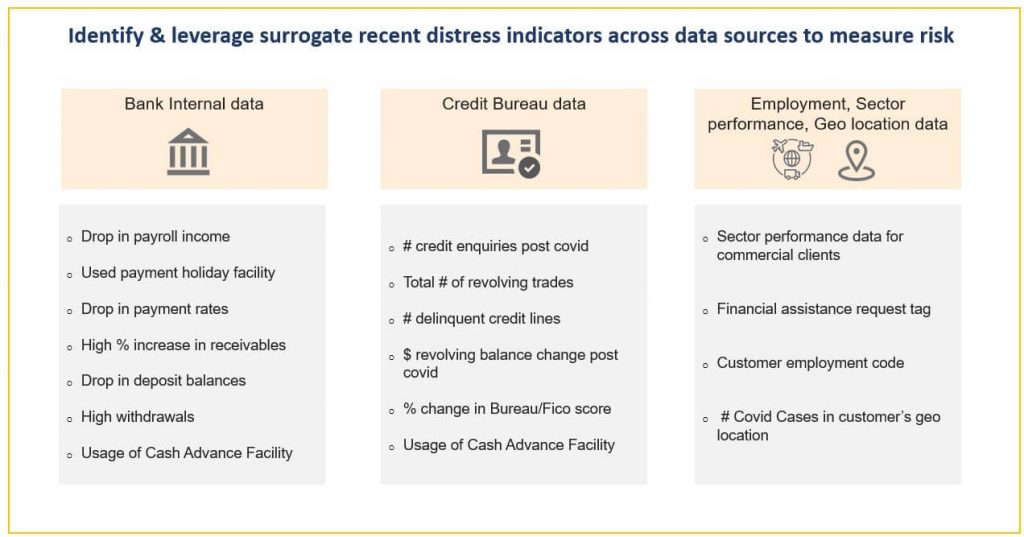

- Covid situational risk assessment – As a starting point, Risk managers should identify the distress indicators that capture the situational risk posed post Covid-19. These indicators could be a firsthand source of customer’s situational risk (e.g. drop in payroll income) or surrogate variables like higher utilization or use of cash advance facility on credit card etc. Banks would need to leverage a combination of internal and external parameters, such as industry, geography, employment type, customer payment behavior, etc. to quantify COVID based situational risk for a given customer.

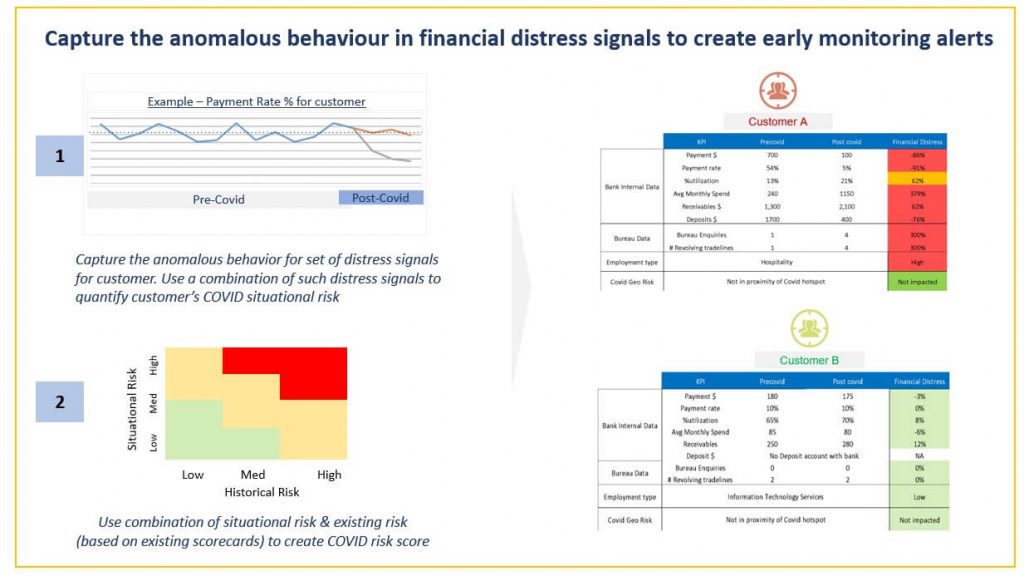

- Early warning alerts & heuristic risk scores based on a recent behavioral shift in customer’s risk profile – A sudden change in the financial distress signals should be captured to create automated alerts at the customer level, this in combination with a historical risk of the customer (pre-COVID) should go as a key input variable into the overall risk decisioning process. The Early warning system should issue alerts, alerting the credit risk system of abnormal fluctuations and potential stress prone behavior for a given account.

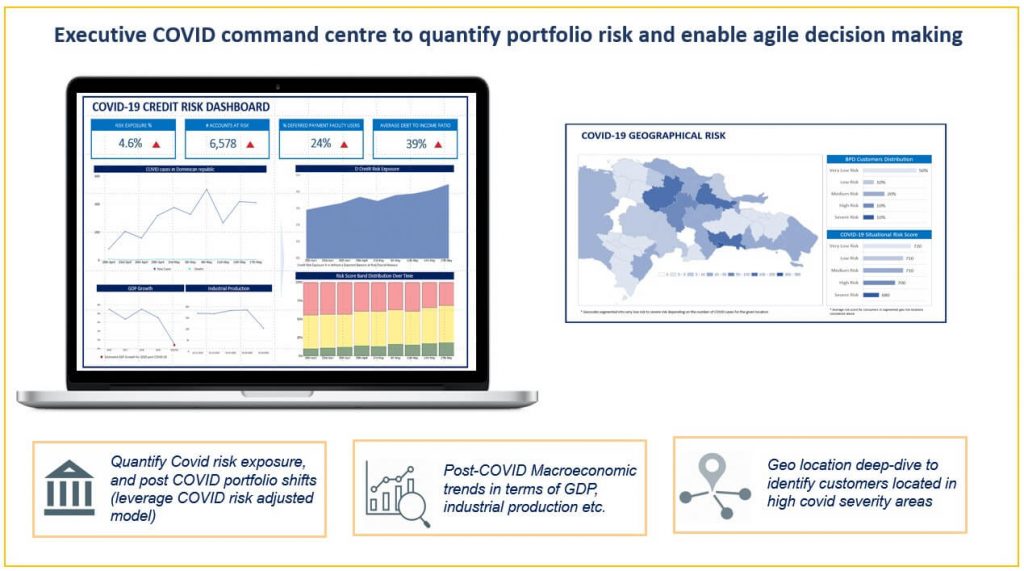

- Executive Command Centre for COVID Risk Monitoring – The re-defined heuristic customer risk scores should be leveraged to quantify the overall risk exposure for the bank post COVID. Banks need to monitor the rapidly changing credit behavior of customers on a periodic basis and identify key opportunities. The rapid risk monitoring based command center should focus on risk across the customer lifecycle and various risk strategies and help provide answers to some of the following questions of the bank’s management team

- What is overall current risk exposure and forecasted risk exposure over short term period?

- How has the overall credit quality of existing customer base changed, are there any patterns across different credit product portfolios?

- What type of customers are using payment moratoriums, what is the expected risk of default of such customer segments?

- Quantification of the drop in income estimates at an overall portfolio level and how it could affect other credit interventions?

- What models are witnessing significant deterioration in performance and may need re-calibration as high priority models?

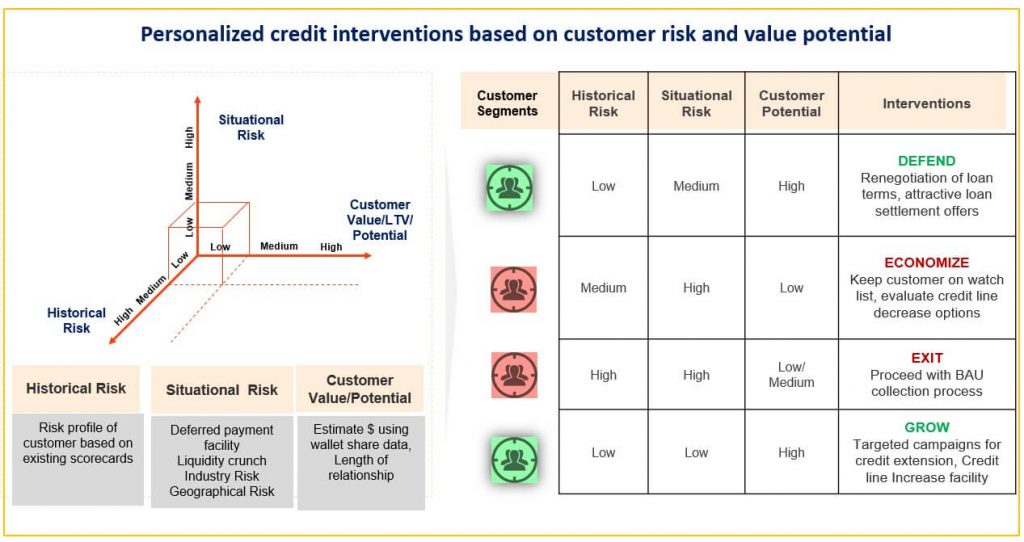

- Personalized credit interventions strategy (Whom to Defend vs Grow vs Economize vs Exit) – To manage credit risk while optimizing the customer experience, banks should use data driven personalized interventions framework of Defend, Grow, Economize & Exit. Using customer’s historical risk, post COVID risk and potential future value-based framework, optimal credit intervention strategy should be carved out. This framework should enable banks to help customers with short term liquidity crunch through government relief programs, bank loan re-negotiation and settlement offers while building a better portfolio by sourcing credit to creditworthy customers in the current low interest rate environment.

The execution of the above-mentioned action plan should help banks to not only mitigate the expected surge in credit risk but also enable a competitive advantage as we move towards the new-normal. The rapid credit decisioning should be backed with more informed decision making and on an ongoing basis, the framework should be fine-tuned to reflect the real pattern of delinquencies.

Incedo with its team of credit risk experts and data scientists has enabled setting up the post COVID early monitoring system, heuristic post COVID risk scores and COVID command center for a couple of mid-tier US based banks over a period of last few weeks.

Learn more about how Incedo can help you with credit risk management.